From the November 2010 newsletter:

As the year comes to a close, you will without a doubt see financial magazines and newspapers predicting what the markets will do in 2011 and suggesting what you should do about it. Most will be supported by a good story, not necessarily evidence.

We already know that successfully predicting stock market movements is extremely difficult–just ask mutual fund managers, Wall Street research analysts, or even your grandparents’ market experts. So if you want to consider it, whether for fun or for profit, you need to be particularly skeptical and careful with your research.

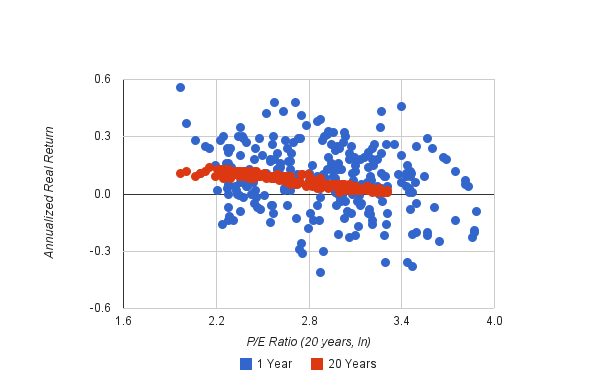

To see what we’re up against, let’s try to estimate future stock market returns using one of the most popular valuation metrics: the P/E ratio. First, take a look at the historical relationship between the P/E ratio (using 20 years of earnings) and the following returns over 1 and 20 years (annualized and adjusted for inflation.)

The two sets of data look completely different. 1-year returns (in blue) are not only highly volatile, but the relationship with P/E ratios does not look very strong. The 20-year annualized returns (in red) are more stable as expected, but they also show a stronger relationship with P/E ratios. It looks like P/E ratios–even when using 20 years of earnings–are not very helpful in predicting 1-year returns. Keep this in mind as you read those 2011 forecasts, especially if they rely on P/E ratios.

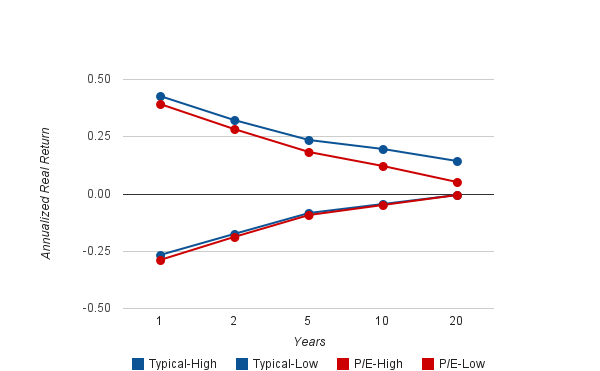

So when are P/E ratios useful? Let’s evaluate the benefit of using P/E ratios to predict returns for the next 1 to 20 years starting at current market levels (S&P index = 1219.) The lines below show the range of predicted returns (plus/minus two standard deviations) with and without the use of the P/E ratio.

The two blue lines show the typical range of returns calculated simply from historical returns. The two red lines show the range of returns predicted by the P/E ratio when using 20 years of earnings. The two ranges do not seem materially different until 10- and 20-year predictions, so we can only consider P/E ratios to be helpful when predicting returns over such long time periods. For short-term predictions, our search for a useful metric continues.

And based on the historical relationship between P/E ratios and returns, it looks like we should expect returns in the lower part of the typical range, particularly over the long term.

Trackbacks