Forecasting company earnings is a critical first step in Wall Street’s favorite pastime–predicting stock market returns. As an investor, you are most likely exposed to forecasted earnings when looking at a version of the P/E ratio that uses future earnings. This ratio uses future earnings subjectively forecasted by Wall Street research analysts, instead of using past earnings that have been objectively aggregated.

The appeal of using future earning is obvious. Which sounds more interesting to you: past earnings, or estimated future earnings incorporating all available information including past earnings? Surely, research analysts employed and trained by Wall Street firms are able to do a decent job in forecasting earnings. Well, let’s look at the evidence.

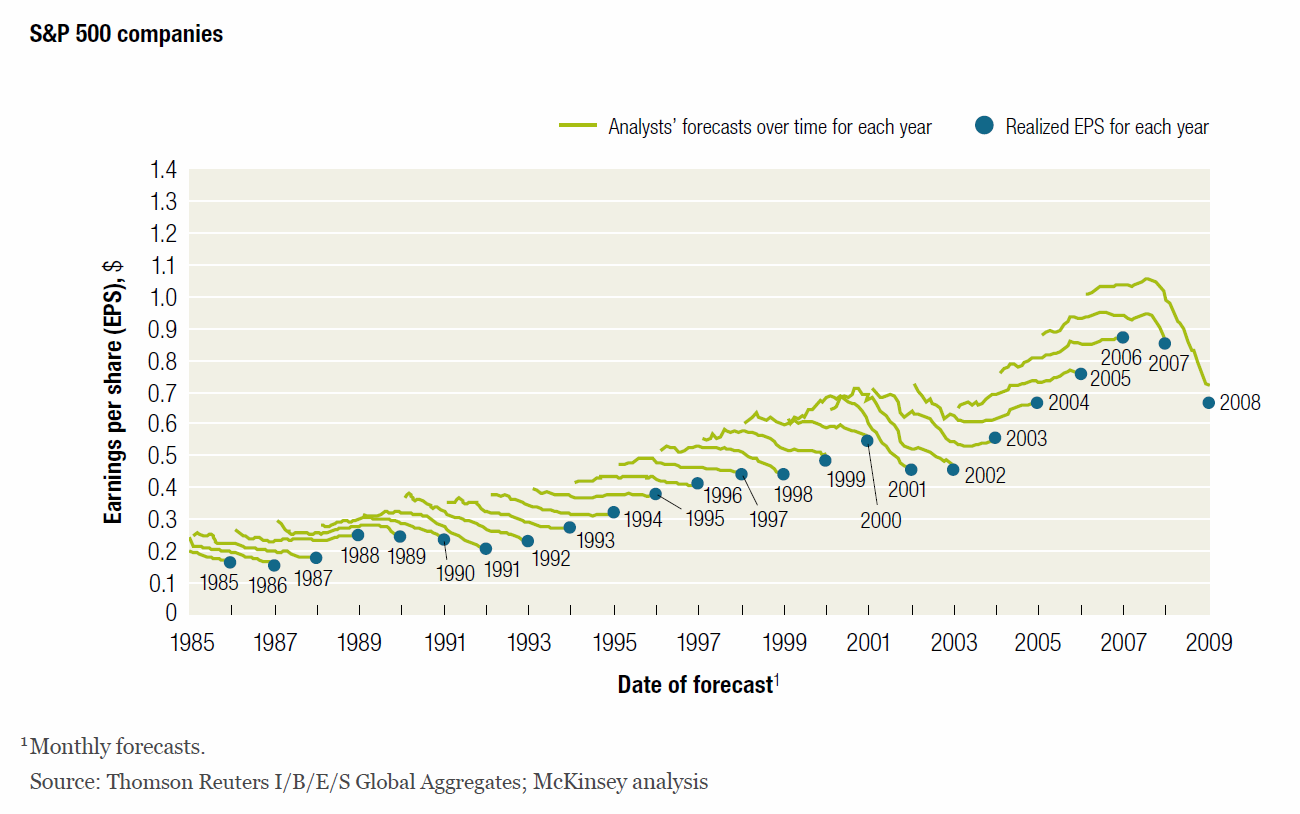

The graph above compares earnings forecasts over time versus realized earnings (green lines are forecasts, blue dots are realized values). Almost all forecasts decrease as their estimated time period gets closer, meaning that forecasts are almost always too optimistic. Over the past 25 years, the earnings growth rates used by research analysts have consistently been much higher than actual growth rates.

Although unfortunate for Wall Street analysts, this poor track record is entirely consistent with studies showing little evidence of skill among mutual fund managers. Remember, less than 10% of mutual fund managers showed market-beating ability before fees, and less than 1% did so after fees. If forecasting earnings were easy, wouldn’t more managers beat the market?

As an individual investor, what does this mean for your investment portfolio? Stick to a long-term asset allocation strategy, and limit any bets to strategies that have actually passed the test of evidence. Stop watching CNBC, and get on with your life.

Source:

“Equity analysts: Still too bullish” by Marc Goedhart, Rishi Raj, and Abhishek Saxena

https://www.mckinseyquarterly.com/Equity_analysts_Still_too_bullish_2565 (pdf)

Trackbacks