This article first appeared in the March 2013 newsletter. Subscribe to get articles like this in your inbox.

As mentioned in the last newsletter and by like-minded analysts, current valuations point to an expensive US stock market relative to market history. To value the market as a whole, our preferred metric is the P/E ratio calculated using 10 years or more of earnings.

One of the most common arguments against this approach is that it ignores interest rates, especially today when they are at historical lows. Surely, we can’t ignore interest rates when we evaluate the stock market, so let’s take a look at how we can take them into account.

Two ways that interest rates could potentially affect the stock market are:

- Interest rates do not change the inverse relationship between current valuations and future returns. When interest rates are low, investors are willing to accept lower future returns and therefore pay a higher price today, making the market look expensive. Low interest rates just provide a rationale for high valuations.

- Interest rates do change the relationship between valuations and returns, so they need to be included when predicting returns.

To test point #1, we can calculate the historical correlation between valuation ratios and interest rates. The following table shows the mild inverse relationship between the two, especially if 10-20 years of earnings are used. Low interest rates do tend to occur with high valuation ratios, but it’s not a strong relationship.

| Valuation Ratio | Correlation with 10yr Treasury Rates |

| P/E (10 yrs of earnings) | -0.14 |

| P/E (20 yrs) | -0.13 |

| P/E (40 yrs) | 0.00 |

Although somewhat interesting, this alone is not very useful for investors. What we want to know is the returns we can expect based on current valuations and interest rates, which brings us to point #2.

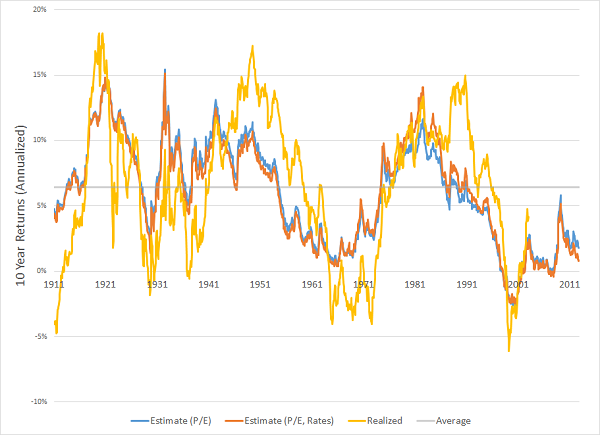

Let’s see if including interest rates helps in predicting future market returns. The following shows returns predicted using P/E alone (blue) and using P/E with interest rates (orange). The actual inflation-adjusted returns earned are in yellow.

Source: Robert Shiller data with Mariposa calculations, as of 3/27/2013.

The blue and orange lines are nearly the same, indicating that return estimates don’t depend on whether you include or ignore interest rates. The more important factor remains current valuations.