One strategy we use to enhance Basic Strategy is to tilt client portfolios toward asset classes that are more attractive based on value and momentum measures.

Let’s look at what this analysis tells us this month.

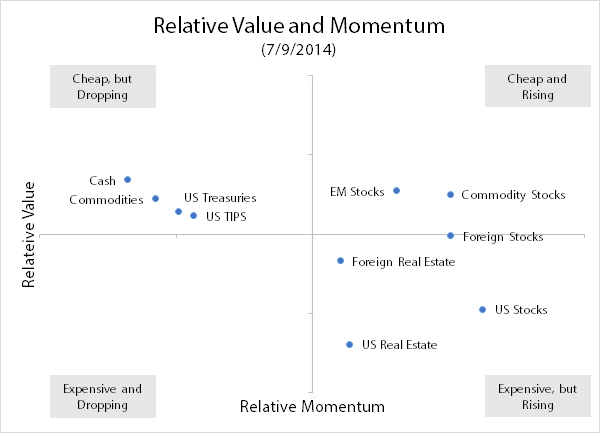

The following chart shows the value and momentum scores for the ten broad asset classes we consider. The upper right area is the ideal spot for an investment, indicating both attractive value and positive momentum. You can see that value and momentum are usually opposites, with most investments attractive in terms of one, but not both.

Source: Mariposa Capital Management, LLC

Source: Mariposa Capital Management, LLC

As of 7/9/2014, the two most attractive asset classes using value and momentum are:

- Global Commodity Stocks

- Emerging Market Stocks

The most unattractive asset classes are:

- Commodities

- US Real Estate

Note

For this analysis, we are using the following funds as proxies for each asset class.

| Asset Class |

Fund |

Ticker |

| US Stocks |

Vanguard Total Stock Market |

VTI |

| Foreign Stocks |

Vanguard FTSE Developed Markets |

VEA |

| EM Stocks |

Vanguard FTSE Emerging Markets |

VWO |

| US Real Estate |

Vanguard REIT |

VNQ |

| Foreign Real Estate |

Vanguard Global ex-US Real Estate |

VNQI |

| Commodities |

PowerShares DB Commodity |

DBC |

| Commodity Stocks |

SPDR S&P Global Natural Resources |

GNR |

| US Treasuries |

iShares 7-10 Year Treasury Bond |

IEF |

| US TIPS |

iShares TIPS Bond |

TIP |

| Cash |

iShares Short Treasury Bond |

SHV |

One strategy we use to enhance Basic Strategy is to tilt client portfolios toward asset classes that are more attractive based on value and momentum measures.

Let’s look at what this analysis tells us this month.

The following chart shows the value and momentum scores for the ten broad asset classes we consider. The upper right area is the ideal spot for an investment, indicating both attractive value and positive momentum. You can see that value and momentum are usually opposites, with most investments attractive in terms of one, but not both.

As of 7/9/2014, the two most attractive asset classes using value and momentum are:

The most unattractive asset classes are:

Note

For this analysis, we are using the following funds as proxies for each asset class.