One strategy we use to improve performance beyond Basic Strategy is to tilt client portfolios toward asset classes that are more attractive based on value and momentum measures.

Value measures try to identify investments that are cheap relative to their theoretical or historical value, while momentum assumes that investments that have done well recently will continue to do so. Combining the two has yielded impressive results.

Let’s look at what this analysis tells us today.

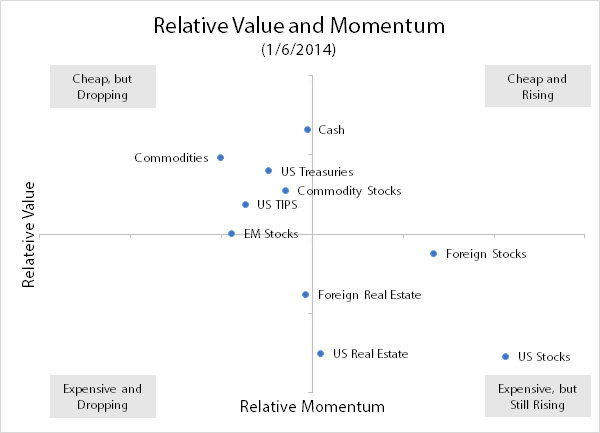

The value and momentum scores for the ten broad asset classes we consider are shown below. The upper right area is the ideal spot for an investment, indicating both attractive value and positive momentum. You can see that value and momentum are usually opposites, with most investments attractive in terms of one, but not both.

Source: Mariposa Capital Management, LLC

As of 1/6/2014, US Stocks are still the least attractive investment in terms of value. However, their impressive gains over the last year also make them the most attractive in terms of momentum. Commodities are in the opposite situation of decent value, but poor momentum. Surprisingly, Cash now shows the best value characteristics (relative to other asset classes).

The most attractive asset classes using both value and momentum are Cash and Foreign Stocks. These two switched positions this month. In contrast, the most unattractive asset classes are US Real Estate and EM Stocks. EM Stocks moved into the bottom two this month, replacing US TIPS Bonds.

Note

For this analysis, we are using the following funds as proxies for each asset class.

| Asset Class | Fund | Ticker |

| US Stocks | Vanguard Total Stock Market | VTI |

| Foreign Stocks | Vanguard FTSE Developed Markets | VEA |

| EM Stocks | Vanguard FTSE Emerging Markets | VWO |

| US Real Estate | Vanguard REIT | VNQ |

| Foreign Real Estate | Vanguard Global ex-US Real Estate | VNQI |

| Commodities | PowerShares DB Commodity | DBC |

| Commodity Stocks | SPDR S&P Global Natural Resources | GNR |

| US Treasuries | iShares 7-10 Year Treasury Bond | IEF |

| US TIPS | iShares TIPS Bond | TIP |

| Cash | SPDR Barclays 1-3 Month T-Bill | BIL |

Trackbacks