Although a long-term asset allocation policy (which we sometimes refer to as Basic Strategy) is the foundation of our investment strategy, we do deviate from it to some extent to improve performance when supported by evidence.

One example is our use of value and momentum measures to tilt client portfolios away from unattractive asset classes and toward attractive ones. Value tries to find investments that are cheap relative to its theoretical or historical value. Momentum assumes that investments that have done well recently will continue to do so.

Using both value and momentum to evaluate investments is more effective than using either alone — although both do work on their own. I will share the evidence supporting value and momentum in a future article, but let’s first look at what this analysis tells us today.

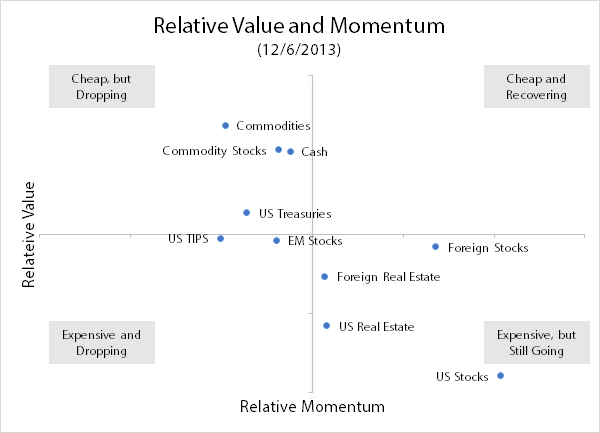

The value and momentum scores for the ten broad asset classes we consider are shown below. The upper right area is the ideal spot for an investment, indicating both attractive value and positive momentum. You can see that value and momentum are usually opposites, with most investments attractive in terms of one, but usually not both.

Source: Mariposa Capital Management, LLC

As of 12/6/2013, US stocks is the least attractive investment in terms of value. However, its impressive gains this year also make it the most attractive in terms of momentum. Commodities are in the opposite situation of good value, but poor momentum.

The most attractive asset classes considering both factors are Foreign Stocks and Cash. Cash moved into the top two this month. In contrast, the most unattractive asset classes are US TIPS and US Real Estate. US Real Estate moved into the bottom two this month.

Note

For this analysis, we are using the following funds as proxies for each asset class.

| Asset Class |

Fund |

Ticker |

| US Stocks |

Vanguard Total Stock Market |

VTI |

| Foreign Stocks |

Vanguard FTSE Developed Markets |

VEA |

| EM Stocks |

Vanguard FTSE Emerging Markets |

VWO |

| US Real Estate |

Vanguard REIT |

VNQ |

| Foreign Real Estate |

Vanguard Global ex-US Real Estate |

VNQI |

| Commodities |

PowerShares DB Commodity |

DBC |

| Commodity Stocks |

SPDR S&P Global Natural Resources |

GNR |

| US Treasuries |

iShares 7-10 Year Treasury Bond |

IEF |

| US TIPS |

iShares TIPS Bond |

TIP |

| Cash |

SPDR Barclays 1-3 Month T-Bill |

BIL |

Although a long-term asset allocation policy (which we sometimes refer to as Basic Strategy) is the foundation of our investment strategy, we do deviate from it to some extent to improve performance when supported by evidence.

One example is our use of value and momentum measures to tilt client portfolios away from unattractive asset classes and toward attractive ones. Value tries to find investments that are cheap relative to its theoretical or historical value. Momentum assumes that investments that have done well recently will continue to do so.

Using both value and momentum to evaluate investments is more effective than using either alone — although both do work on their own. I will share the evidence supporting value and momentum in a future article, but let’s first look at what this analysis tells us today.

The value and momentum scores for the ten broad asset classes we consider are shown below. The upper right area is the ideal spot for an investment, indicating both attractive value and positive momentum. You can see that value and momentum are usually opposites, with most investments attractive in terms of one, but usually not both.

Source: Mariposa Capital Management, LLC

As of 12/6/2013, US stocks is the least attractive investment in terms of value. However, its impressive gains this year also make it the most attractive in terms of momentum. Commodities are in the opposite situation of good value, but poor momentum.

The most attractive asset classes considering both factors are Foreign Stocks and Cash. Cash moved into the top two this month. In contrast, the most unattractive asset classes are US TIPS and US Real Estate. US Real Estate moved into the bottom two this month.

Note

For this analysis, we are using the following funds as proxies for each asset class.